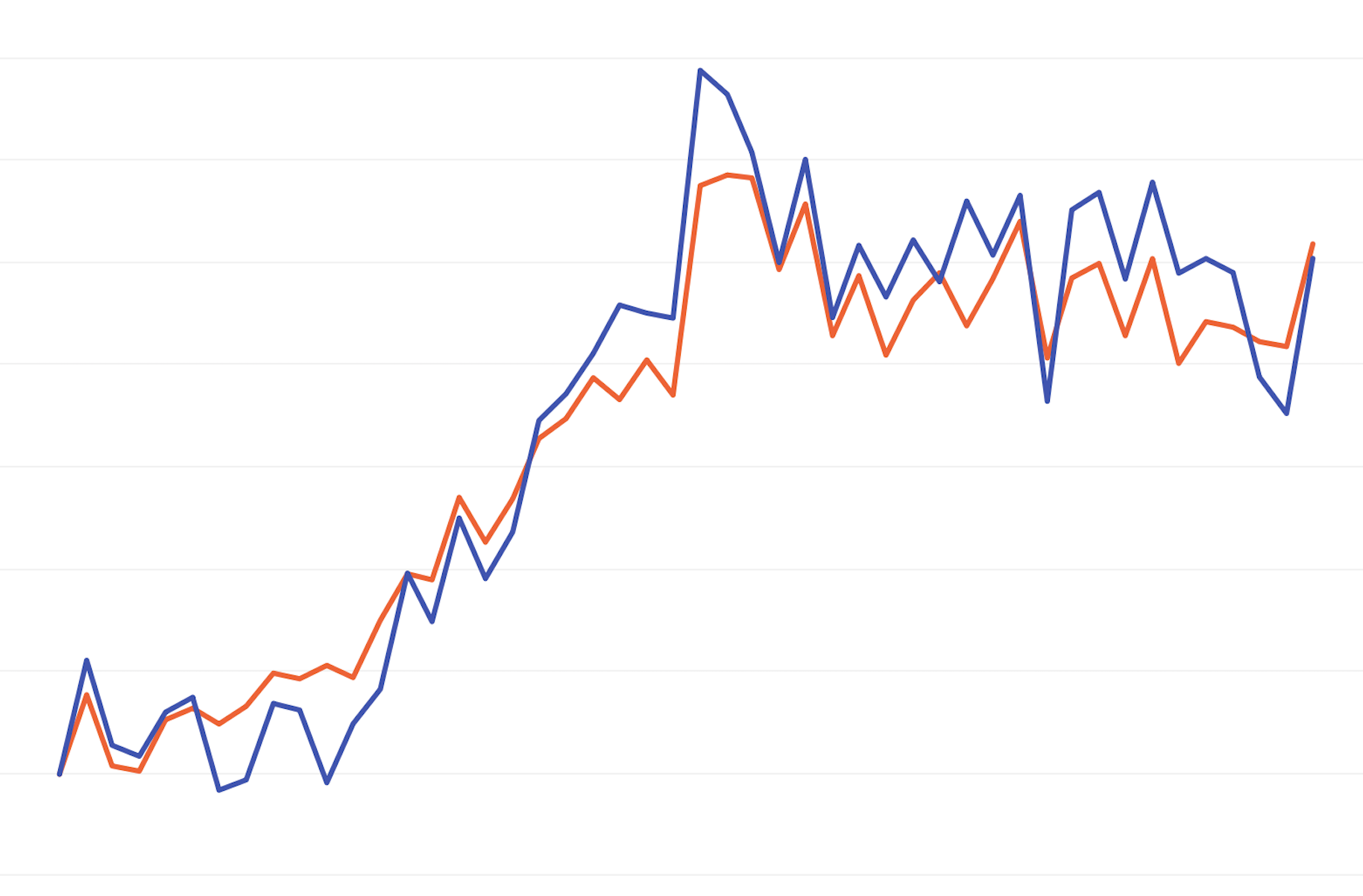

“Although hosts in some markets are seeing a correction after a pandemic-driven boom, on the whole, demand remains very strong and we aren’t yet seeing an ‘Airbnb bust.'”Īirbnb itself says that in turn, hosts are finding success booking guests on the platform. “Demand is still rising every month, and so are Airbnb’s bookings and revenue,” says Lane.

“Properties that are in markets with the greatest supply growth are seeing the biggest declines in performance,” Lane says.īut as some Airbnb hosts experience declining occupancy rates-and as the country’s economic outlook is uncertain-Airbnb is by and large having a banner year. In August, AirDNA reported that markets where supply had grown by more than 50% had an average occupancy decline of over 10% and saw revenues drop by 8%. short-term rental markets from July through September, according to AirDNA. Hosts complaining of low bookings weren’t imagining things: Occupancy rates fell in 31 of the top 50 largest U.S. Now, Marr says, things have changed: ”The rapid surge in mortgage rates and the resulting fewer homeowners motivated to sell now have kept home prices high and the affordability crisis raging.” The deal with high demand

“A lot of the supply in these markets shifted away from the for-sale market and long-term rental market towards the short-term rental market amidst a surge of demand for Airbnbs and other vacation rentals,” says Taylor Marr, deputy chief economist for real estate brokerage Redfin.

0 kommentar(er)

0 kommentar(er)